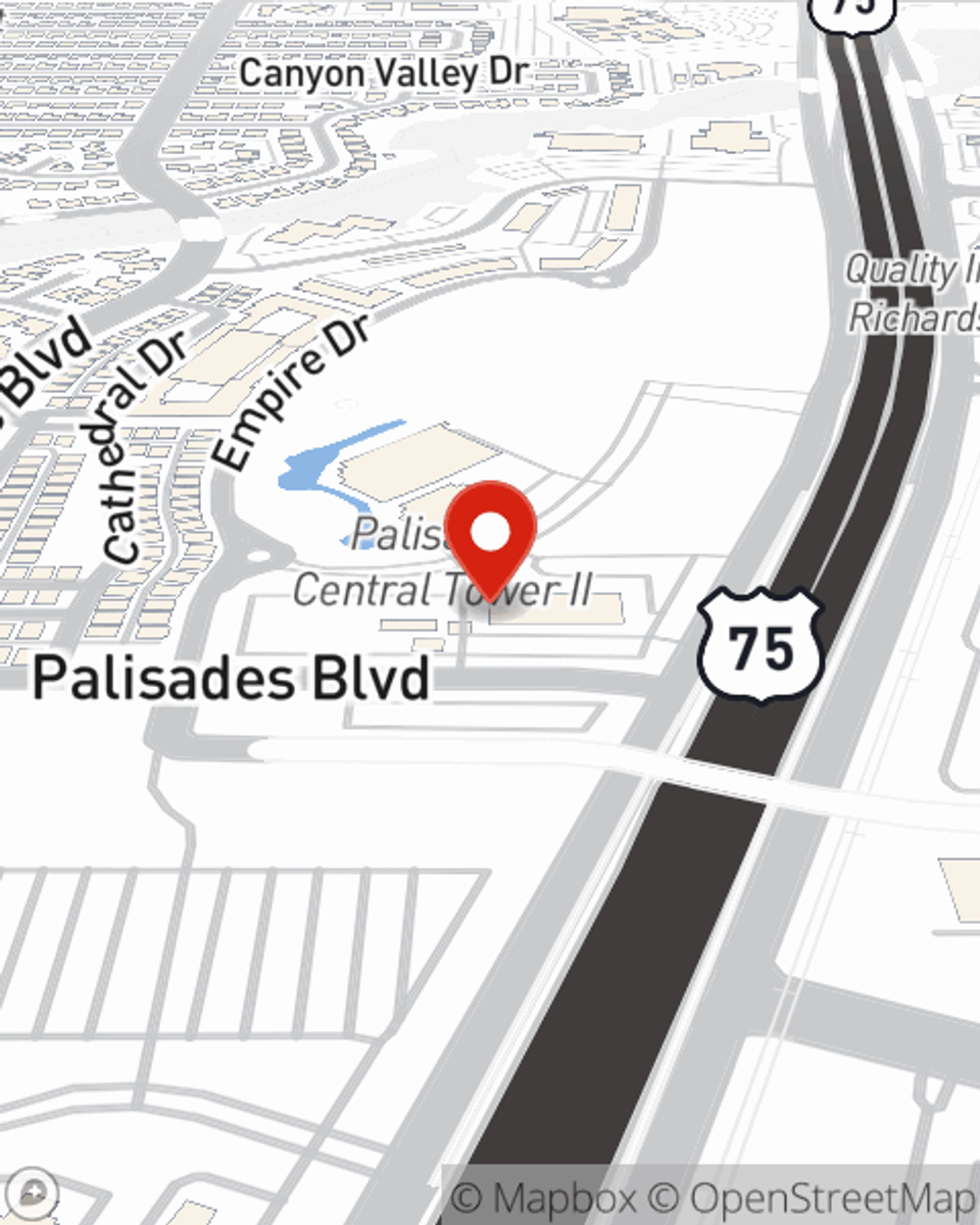

Life Insurance in and around Richardson

Protection for those you care about

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

Be There For Your Loved Ones

You might think you don’t need to worry about life insurance while you are young. Actually, it’s the opposite! It’s much better to secure your life insurance in your 20s and 30s. That’s why your Richardson, TX, friends and neighbors both young and old already have State Farm life insurance!

Protection for those you care about

Now is a good time to think about Life insurance

State Farm Can Help You Rest Easy

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With a protection plan from State Farm, you can lock in outstanding costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Dan Ward or one of their resourceful team members. Dan Ward can help design coverage options for the level of coverage you have in mind.

If you're a person, life insurance is for you. Agent Dan Ward would love to help you find out the variety of coverage options that State Farm offers and help you get a policy that's right for you and the ones you love most. Call or email Dan Ward's office to get started.

Have More Questions About Life Insurance?

Call Dan at (972) 422-5888 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.